The Apprasial

A home appraisal is an unbiased evaluation of your home’s worth. An objective third party will review various factors of your property and assign a value for what it should sell for. Home appraisals can help sellers set competitive prices so their listings generate offers while still turning a profit. On the buyer side, mortgage lenders often require home appraisals before approving loans to confirm it is selling at a fair price.

But what factors contribute to a home appraisal anyway? Is there anything you can do as a homeowner to increase the appraiser’s value estimate? Here are 10 factors that affect a home appraisal so you can show your property in its best light.

Location

The home location is the first thing every home appraiser looks at – and one factor that is completely out of your control. The appraiser will consider the value of homes in the neighborhood as a whole before they ever look at your specific property. A house in a historic district might have a higher value than one in a business district. They will also consider additional factors that can raise or lower your home value. These include:

- How close your home is to other properties, the street, and neighborhood amenities like a fire station.

- Whether noise pollution (like a nearby airport or interstate) could create a poor living experience.

- The home’s proximity to schools, parks, and other assets that make it desirable.

- Whether the neighbors add or detract from the living experience. (Overgrown grass, a constantly-barking dog, or rude people can make homeownership a nightmare.)

Two homes of similar size in the same neighborhood could receive different appraisals if one is located right next to a major highway and the other is tucked into a quieter area.

Home Size

The next step after considering the location of your home is its size. The appraiser will consider the home’s square footage, bedrooms, and bathrooms available to potential buyers. These professionals have formulas that assign valuations based on these concrete numbers. Unless you recently added a bathroom or built an extension on your house, this part of the home appraisal is also out of your control.

The construction materials of your house can also affect its appraised value. Consider the structure of a house in a hurricane-prone area like Florida. Appraisers often favor homes made of cement blocks over wooden frames because they are meant to withstand hurricane-force winds. These homes are less of a liability for buyers and lenders, thus increasing their value.

While you can’t completely rebuild your home, you can take steps to increase the value of your property by investing in modern materials. Consider your roof. If your home is in need of a roof replacement, you can increase the perceived value by replacing basic asphalt shingles with heartier slate shingles or metal roofing.

Evaluate how different structural changes affect your home value. For example, a brand-new roof that costs around $7,500 has the potential to increase your home’s value by more than $8,000. You can make your home more sellable and get more money in the sale.

Comparable Properties in the Local Market

The current housing market in your area can affect how an appraiser values your home. They will look at homes nearby that sold in recent conditions to get an idea of what your home is worth. For example, if you and your next-door neighbor have twin houses and their home recently sold for $350,000 then it’s likely that your house will be valued at a similar rate.

This sales comparison of the surrounding area also shows that you can’t trust a dated home appraisal. If you received a home appraisal a year ago, its valuation might be irrelevant based on the current market. Your home value will increase or decrease every few months (especially in a volatile market). You may need to get a fresh appraisal if a lender requires one.

Curb Appeal

Some of the most surprising factors that can affect a home appraisal can be found in the small details of a home. Your curb appeal comprises your driveway, house exterior, and any plants (trees, bushes, and flowers) that grow in your yard. First impressions are incredibly important – even for an objective home appraisal. If the first thing your home appraiser notices is a worn-out home with an overgrown yard, they might devalue your property.

Spend some time improving your home’s exterior to prepare for the appraisal process. Pressure wash your home and driveway. Make repairs to driveway cracks and damaged areas of the house. Prune, plant, and improve the plants in your yard. Whether you live in a suburban neighborhood or an urban townhouse, curb appeal matters.

Storage Space

There’s good news for fashionistas who are proud of their walk-in closets and shoe displays: storage is almost always considered an asset with it comes to the home appraisal process. People from all walks of life want extra closet space, whether the future homeowner needs storage for holiday decorations or their kids’ toys.

If you are planning to sell your house, now is the time to declutter. Donate or throw away the items you no longer need. Organize your closets, which will make them look bigger. The more storage you have and the bigger the closets, the better your home appraisal should be.

Foul Odors and Mess

Does cleanliness affect a home appraisal? It shouldn’t unless the home appraiser finds that the condition of the home can negatively impact the sale or value of the property.

For example, a messy house that has dishes in the sink and clothes on the floor shouldn’t affect the appraised value. However, if the house is dirty to the point where odors permeate throughout each room and the carpet is so dirty it needs to be replaced, then the value will go down. The smell of cigarette smoke alone can lower the final value of a house by up to 30 percent.

Odors and stains can also serve as warning signs that something is wrong with the house. Water stains could point to leaks in the roof or broken pipes. Musty odors could make the appraiser worried about mold. Signs of insects or rodents could alert the appraiser to an infestation or termite damage.

Before the appraiser arrives, consider hiring a professional cleaning company. They will work to remove odors and make your home shine like new. That way you won’t let a messy house affect your appraised value.

Over Personalization

Small touches can make your house more comfortable for you and your family – but too much personalization could negatively affect your market value. For example, a pool can increase the value of your home. Choosing a pool shape that matches your company logo can reduce it. The shape is so niche that most buyers won’t understand why the pool looks at way.

If you have specific uses for rooms in the house, try to modify them ahead of the home appraisal. You want to make your property seem generic enough to appeal to the average buyer.

This is where staging comes in. If you have a house that has four bedrooms and two of them are used as home offices, you might want to stage them to look like bedrooms ahead of the appraisal. After all, too few bedrooms can deter families from looking at your house because they need to accommodate their kids.

Even if your home is in good condition, your appliances could affect the home appraisal. Few homeowners could last more than a day or two without a functioning hot water heater. If yours is dated and about to break, it can hurt your appraisal value.

Other appliances like your washer and dryer, refrigerator, air conditioning system, and stove can all impact your home appraisal. This is particularly true if your home was designed to feature these appliances – like a large kitchen with luxury, commercial-style units for aspiring chefs.

You might be able to get a better home appraisal by investing in new appliances before your list your house.

Heating and Air

Depending on where you live, air conditioning is either a requirement to live or a bonus of buying your house. Buyers will expect your house to have a working air conditioning system if you live in traditionally hot states like Arizona, Florida, Texas, and Nevada. While AC units are less common in states like New Hampshire, Oregon, and Washington, recent heat waves are pushing more homeowners to install these units.

Your home appraisal will vary depending on whether you have central heating and air or rely on window units. The age and design of the system can also impact your results. Consider installing or upgrading your system ahead of a home appraisal to maximize your property values.

One That Shouldn’t: Race and Ethnicity

While home appraisers are meant to be objective in their evaluation of the property, studies show that appraisers often devalue homes that are owned by black and Latino families. One family in Baltimore shared their experience where an appraiser initially valued their home at $472,000. The family removed all of their photos from the home and asked a white colleague to show the house. The new home’s appraisal was $750,000.

This experience in Baltimore isn’t unique. Lender Freddie Mac launched an official study to review racial bias in home appraisals. It found that appraisers’ views of houses are more likely to fall below the contract price if they are located in predominantly black or Latino census tracks.

Low appraisals can lead to denials of home loans for buyers and lower profit margins for sellers. They can also devalue entire neighborhoods because appraisers look at comparable home prices.

As a homeowner, you have spent countless hours improving your house and making it a great place to live. A home appraisal can be a tense experience because you want to see if others objectively value your home at the same level you do. However, many of the factors are out of your control – no matter how many candles you light and cookies you bake.

Certified Probate & Trust Specialist

As a Certified Probate & Trust Specialist you can rest assured that as a Real estate professional, I have the understanding of the Probate transaction and can represent sellers or buyers in probate transactions, as well as investors looking to purchase probate properties.

© 2025 All Rights Reserved.

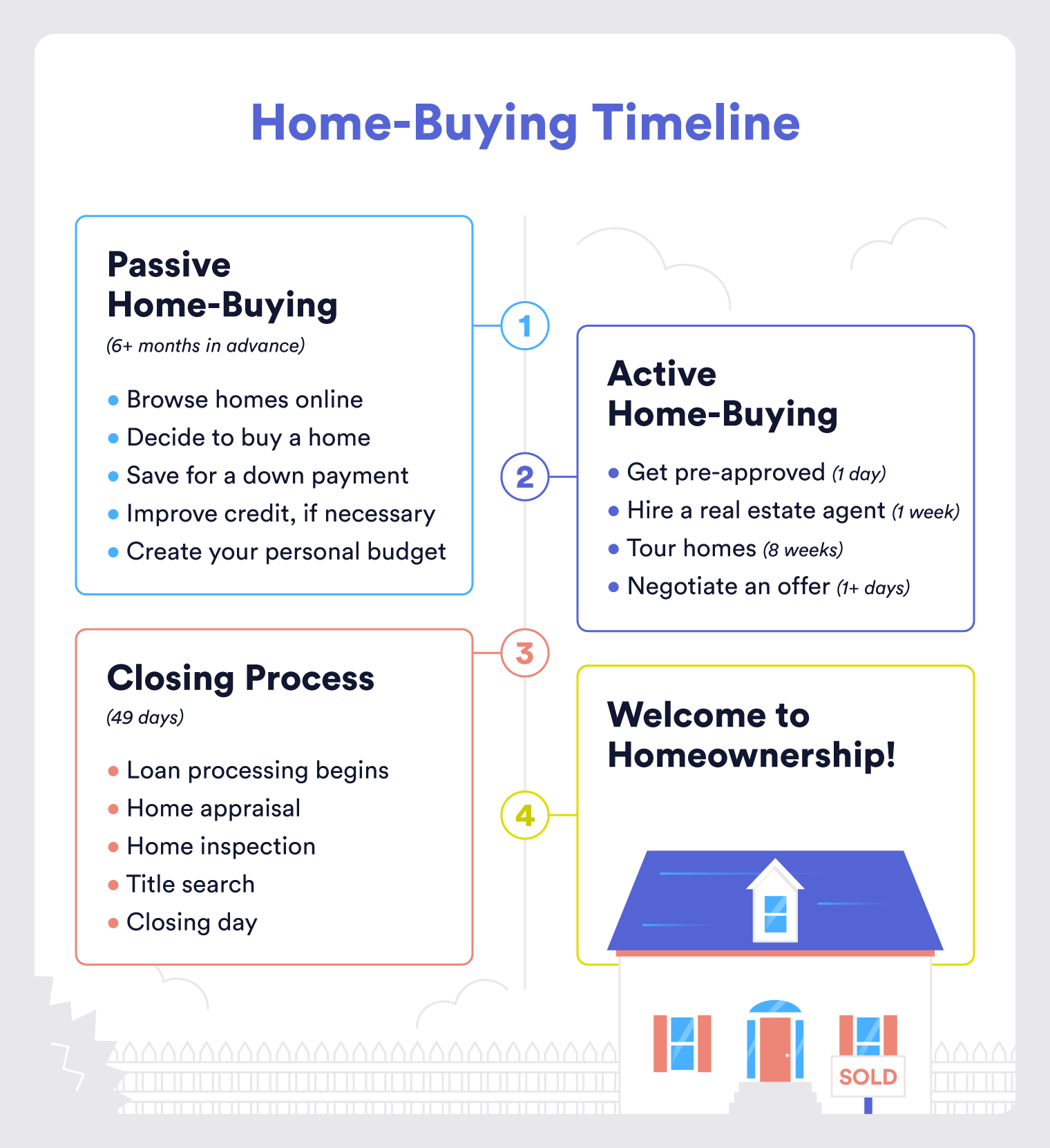

Home Buying Timeline

Many home buyers begin their journey before talking to a lender. Home-buying begins when you first see yourself as a future homeowner.

If you’ve browsed houses online or stopped by an open house in person, you’ve started passive home-buying. Homeownership is something you’d like for your future, and knowing the timeline for buying a house will help guide you.

Here’s a breakdown of the home-buying timeline so you can prepare and plan your path to homeownership.

- Begin Planning to Buy a House

- Choose a Mortgage Lender

- Hire a Real Estate Agent

- Shop For Your New Home

- Make An Offer

- Loan Processing and Underwriting

- Close On Your New Home

How Long Does It Take To Buy a House?

Buyers can find and purchase a home in as little as 15 weeks, and up to eight months.

Once you decide it’s time to buy a house, your first step is to get a mortgage pre-approval.

Buyers can be pre-approved in just one day. Then, the typical buyer tours nine homes over four weeks before finding their ideal house.

After you submit an offer and are under contract, it takes an average of 49 days to close and get your keys. With these estimates, you can move into a new home in four months or less.

These time frames can vary, as some lenders close quicker, some buyers take longer to choose a home, and some sellers take longer to accept an offer.

Here’s every home-buying step you can expect to take, from viewing listings to moving into your new home.

1. Begin Planning To Buy a Home

6+ months in advance

This is a time to determine your homeownership goals. Do you need more space for a growing family? Some buyers want a yard for their pets or outdoor hobbies. Others want to invest in a home and build wealth.

Your goals can help you decide what kind of home you want and when you’d like to move.

This is also a good time to evaluate your finances and build a monthly budget. A specific budget allows you to see how much you want to pay on a monthly mortgage. It also helps you set savings goals for your down payment and closing costs, unless you choose 100 percent financing.

If you’re worried about approval with your current finances, consider down payment assistance options and accessible loan types.

2. Choose a Mortgage Lender

1+ days

A mortgage lender can help you decide which loan type is right for you. They’ll also help you consider down payment options and strategize to improve your credit score if necessary.

Most first-time home buyers choose a conventional 30-year mortgage. The longer loan term makes homeownership accessible with a lower monthly mortgage payment.

Buyers who aren’t eligible for a conventional mortgage may consider government-backed loans. FHA loans are a great option for buyers looking for a loan with low down payment and less restrictive credit score requirements.

USDA and VA loans have no down payment or credit score requirements.

3. Get a Mortgage Pre-Approval

1+ days

A mortgage pre-approval shows you how much home you qualify for. The best time to get a pre-approval is before you start house hunting. This can be two months or a year in advance — whatever makes sense for you.

Pre-approvals are a dress rehearsal for your mortgage and are necessary to make a serious offer on a home. Know that pre-approvals don’t guarantee your mortgage approval or interest rate and they typically expire after 90 days and can be refreshed if you don’t find the home you’re looking for in that time.

Hire a Real Estate Agent

1+ weeks

Source: NAR

Buyer’s agents help you find homes, communicate with the seller, and negotiate the home sale. An experienced real estate agent knows the neighborhoods and provides insights into the local housing market.

Your mortgage lender can recommend agents in your area. You can also ask family and friends who they’ve worked with.

It’s key to get a real estate agent that represents you, instead of a dual agent that represents the seller, too. This home buyer mistake can prevent both the buyer and seller from having fair representation.

“Using the listing agent is like stepping into a courtroom and using the opposing side’s legal counsel. Everyone is entitled to have their own representation, and should.”

Also, home sellers cover all real estate agent fees unless otherwise stated.

Many buyers only meet with one real estate agent, but it’s important to find someone you connect with. Take the time to build a home-buying team that’s equipped to represent you well.

Your Homebuying Team Is A Lender, an Agent, an Appraiser, an Inspector, and an Escrow Agent

5. Shop for Your New Home

8 weeks

House hunting is an exciting time to explore properties until you find your dream home.

It’s helpful to know what you want ahead of time, refine your home search, and guide your real estate agent. If you’re not sure what your dream home looks like, touring properties can help you set those expectations.

Keep a list of your must-haves, nice-to-haves, and deal-breakers. This can save you time touring and helps you make your final housing decision.

6. Make An Offer

1+ days

Once you find a house you love, your real estate agent will help you make an offer on the house. Decide details like your earnest money deposit and contingencies in advance so your offer letter template is ready to go.

An offer letter typically includes:

- The name of the seller

- The address of the property

- The names of anyone who will be on the title, including yourself

- The purchase price you’re offering and down payment

- The earnest money deposit

- Any contingencies you’d like to include

- Any concessions you’re requesting from the seller

- A complete list of fees and closing costs

- The dates you’d like to close on the home

- Your preferred move-in dates

- A deadline to respond to the offer

Real estate laws vary by location, so you may need additional information. Your real estate agent or attorney can confirm that your offer letter complies with local regulations.

7. Loan Processing and Underwriting

1+ days

Loan processors comb through your mortgage application and ensure they have everything needed for full mortgage approval.

Next, the application goes to the underwriter for verification. Underwriters look for inconsistencies in your credit report, credit score, and property details. If anything comes up, the underwriter will reach out with questions.

You’ll complete other closing processes during this phase, too.

Home Appraisal

Home appraisals determine the value of a home with an inspection from a qualified third-party appraiser. Appraisals are required for any home purchase, sale, or refinance.

Appraisers perform a visual inspection of the home and collect specific property and housing market data. This can include:

- Floor plan

- Square footage

- Home amenities and features

- Property’s neighborhood

- Local housing trends

- Similar home sales

The appraiser then considers this data to determine the home’s value.

Once the appraisal is complete, buyers receive a report detailing the property, neighborhood, and local housing sales.

As a home buyer, the appraisal allows you to know your home’s value and can influence the buying process.

If the appraisal projects the house is of equal or higher value than the sale price, the home sale continues. If the appraisal finds the home’s value is less than the sale price, the buyer has the opportunity to negotiate.

If the seller isn’t willing to negotiate, your mortgage lender is unlikely to approve the mortgage for a higher amount than the home’s worth. At this point, you can walk away from the deal or pay the difference between the appraised value and the purchase price.

Home Inspection

A home inspection provides insight into the current condition of a home and its features. Home inspections aren’t required, but highly recommended and are often a contingency in your contract.

Home inspectors look at the interior and exterior of the home, covering everything from plumbing to the foundation.

They don’t look at sewage pipes, behind electrical panels, or inside interior walls.

Once finished, the inspector provides a report highlighting:

- Safety concerns

- Major and minor defects

- Items that need to be replaced

- Items that need to be repaired

- Items that may need to be repaired

As the buyer, you get to choose if you’d still like to purchase the home given the report’s findings.

If you still love the home but don’t want to pay to replace the roof, you have room to negotiate. You can ask that the seller fix the issue or lower the sale price to accommodate the repair.

Buyers have seven days after an inspection to decide to purchase or walk away from the sale. If you choose to waive the home inspection contingency in your offer, you choose to purchase the home as is. But an inspection is still recommended for your own information.

Title Search

Title companies perform a title search to determine who owns the property for sale and has the right to sell it. They’ll also look for an easement or right of way that may prevent you from completing projects, like installing a pool.

The end goal is to ensure the seller has the right to sell the home, and protect the buyer’s future ownership.

This seems straightforward, but divorces and inherited ownership can complicate things. If someone other than the seller has some ownership in the property, they can interfere with the sale.

You’ll also receive a title report to ensure the property can be legally transferred to you.

8. Close On Your New Home

3 days

When the closing reports are complete, you’ll receive a closing disclosure to review and finalize your loan. This specifies the loan’s terms and costs with exact figures.

It’s a good idea to perform a final walk-through and inspect the home to ensure everything is in good shape for move-in.

Finally, you’ll come to closing day. You and the seller will sign the final paperwork, transfer necessary funds, and you’ll get your keys.

Congratulations! You’re a homeowner, and it’s time to celebrate.

Homeownership is a journey that can start well before you ever consider pre-approval. Understanding the timeline for buying a house will help you prepare for the process and eventually buy the home of your dreams.

Finally, the House Warming Party

Schedule Showing Appointment

© 2025 All Rights Reserved.

Renting vs Buying

Sometimes You Choose Between Building Wealth and Having a Life

Investing in real estate, whether for profit or to avoid “throwing your money away” by renting a home, has inherent risks. But, renting throughout your adult life comes with a certain amount of insecurity as well, and can make building wealth considerably more challenging. Most people in the United States, all the way back to Thomas Jefferson, would tell you that home ownership is the path to freedom and security.

But buying a home is far from a sure thing in terms of making an investment. Just ask anyone who purchased a home when the overall market was at its peak in 2006 or 2007 only to have to wait the better part of a decade in order to get “right side up” or “out from underwater” on their mortgage.

There are no absolutes in terms of whether buying or renting is the right thing to do. However, depending on your circumstances and where you are looking to rent or buy, there are some general considerations that may make the decision a bit easier.

When Renting Just Makes Good Sense

Depending on the type of person you are, there can be serious financial benefits to renting over owning in most markets throughout the country. Studies have shown that if a person was to invest the same amount of money they would normally spend on a down payment in a variety of stocks that simulate the general risk involved with homeownership, that at the end of eight years, the investment in stocks came out ahead of the appreciation and equity realized by the investment in a home.

Regardless of which is better in terms of building wealth over the long haul, buying a home in many urban markets throughout the United States can seriously cut into a person or family’s quality of life.

With property values now all but recovered from the Great Recession, the income to debt ratio associated with purchasing a home in many urban markets has made homeownership unattractive or all but impossible for those who aren’t earning well above the median for their area.

When You Should Seriously Consider Becoming a Homeowner

The verdict may still be out over whether it makes better financial sense to rent throughout your lifetime or to buy in general, but depending on where you live and how long you intend to stay there, there are strong arguments in favor of purchasing a home under certain circumstances.

Beyond the financial arguments, there is the sense of pride and security that comes with owning property and knowing that you won’t ever be subject to a no-cause eviction. If you are planning to stay in the same place for at least five to seven years and paying a mortgage won’t make for a considerable financial hardship (in comparison to renting a similar home), then homeownership can have serious financial benefits, as it acts as a type of forced savings account, building wealth for the homeowner over time.

Additionally, purchasing a home in a volatile market can help you lock in a livable financial situation for yourself as rents continue to rise around you. There are also tax advantages to owning your home, vs. renting.

When The Best Reasons May Not Make a Difference

For many, weighing the overall financial benefits of renting vs. buying and the relative financial hardship of purchasing a home in a developed or developing market will not even come into the decision on purchasing vs. renting. Many who believe in the power of homeownership will scrape together whatever they can to purchase a home, regardless of whether it’s a good idea in that market at that time, or not. Others may never believe that they’re in a position to consider buying a home, given what they wish to spend their income on. They may both be wrong and right.

Certified Probate & Trust Specialist

As a Certified Probate & Trust Specialist you can rest assured that as a Real estate professional, I have the understanding of the Probate transaction and can represent sellers or buyers in probate transactions, as well as investors looking to purchase probate properties.

© 2025 All Rights Reserved.