Squatter Rights in California

Criteria for Adverse Possession in California:

- Hostile Possession: The squatter must occupy the property without the true owner’s permission or consent.

- Actual Possession: The squatter must exercise control over the property by actively living in it and treating it as their own.

- Continuous Possession: The squatter must remain in possession of the property for a minimum of five years without interruption.

- Open and Notorious Possession: The squatter must occupy the property in an open and notorious manner, making it obvious to the public that they are the occupant.

- Payment of Taxes: The squatter must pay all taxes, fees, and bills associated with property maintenance for five consecutive years.

- Exclusive Possession: The squatter must live alone and not share the property with others.

How to Evict a Squatter in California:

- Cash-for-Keys: Offer the squatter a payment to leave the property.

- Rent-to-Own: Offer the squatter a rent-to-own agreement.

- Written Permission: Offer the squatter written permission to remain on the property.

- Eviction Notice: Serve the squatter with an eviction notice, which must be posted on the property and served personally.

- Unlawful Detainer Lawsuit: File an unlawful detainer lawsuit in court to have the squatter removed.

Consequences of Not Meeting the Criteria:

- Failure to meet the criteria for adverse possession can result in the squatter being considered a trespasser.

- The property owner can take legal action to remove the squatter and regain possession of the property.

- The squatter may be liable for damages and costs incurred by the property owner.

Conclusion:

Squatter rights in California are complex and require a thorough understanding of the law. Property owners must be aware of the criteria for adverse possession and take steps to prevent squatters from claiming ownership of their property. If you are dealing with a squatter, it is essential to consult with a legal professional to ensure you are taking the appropriate steps to protect your property rights.

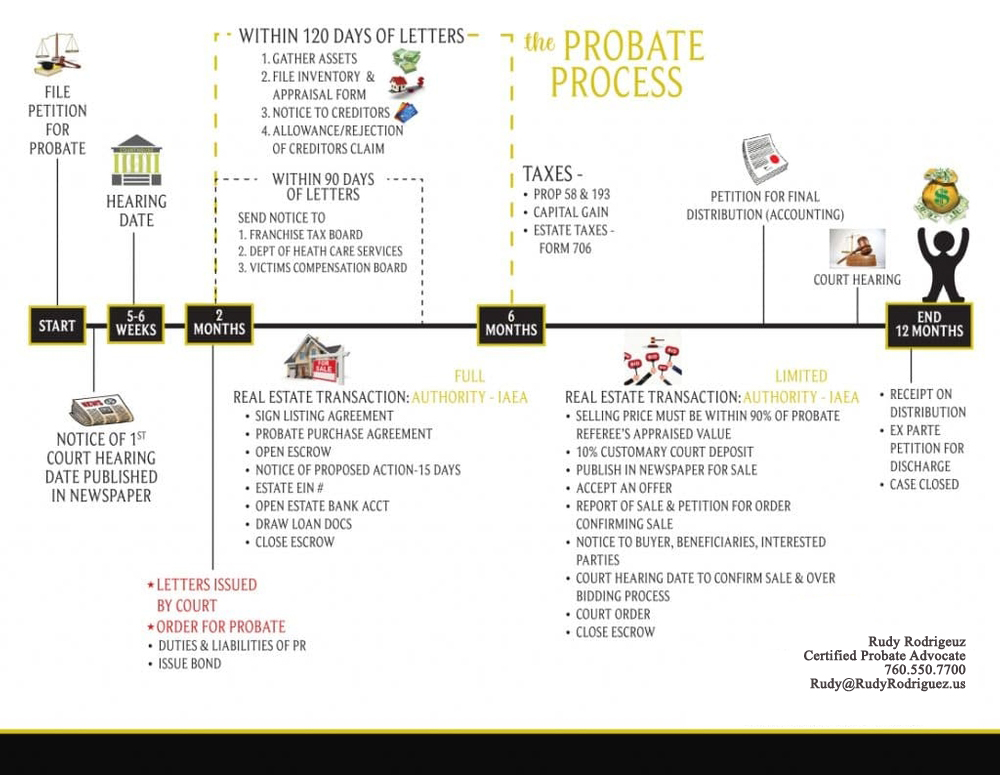

Certified Probate Specialist

As a Certified Probate & Trust Specialist you can rest assured that as a Real estate professional, I have the understanding of the Probate transaction and can represent sellers or buyers in probate transactions, as well as investors looking to purchase probate properties.

RudyRodriguez.us Copyright 2025